OCCH NUMBERS

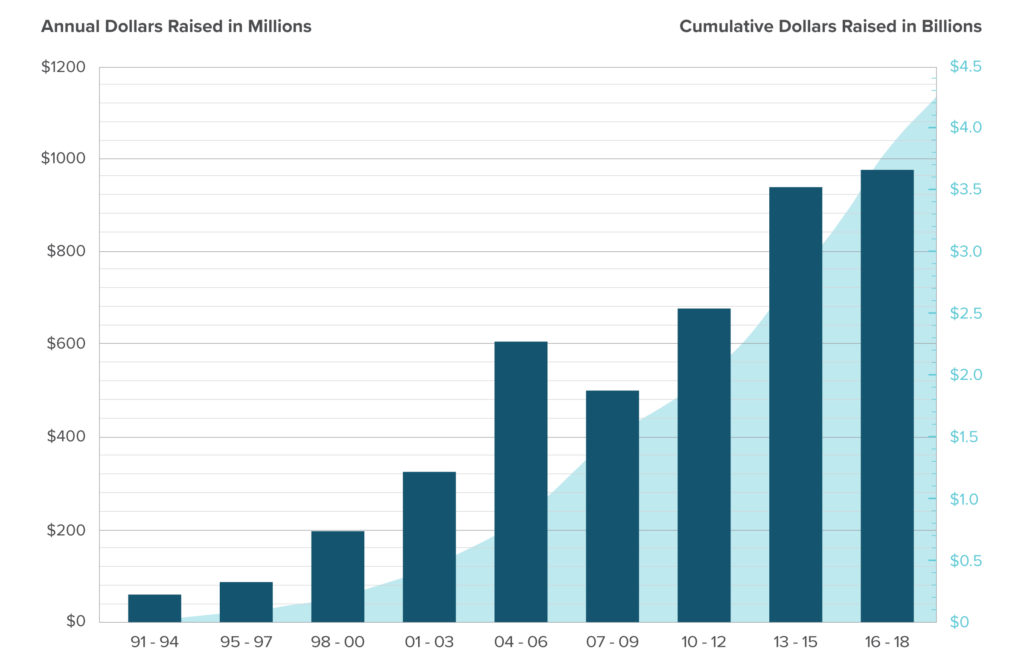

Since 1989, OCCH has invested more than $4.25 billion in sustainable affordable housing development and community revitalization. We partner with the most innovative and mission-focused organizations in community development and social services, and seek to impact the lives of our residents and the quality of life in the neighborhoods we serve.

Equity Investment

Affordable Housing Units

Developments

Foreclosures

Affordable Housing Investment

As a trusted syndicator of low-income housing tax credits (LIHTC), OCCH invests capital—and experience—into helping partners create affordable housing opportunities and sustainable communities. We work side-by-side with our investment partners to continue to produce the greatest impact and provide opportunities to low income families and individuals.

Investment Partnerships

OCCH’s expertise in technical services, knowledge of local markets and changing market conditions, innovative services, and competitive pricing allows us to invest in a significant percentage of the LIHTC properties in Ohio, Kentucky, and surrounding areas. Our track record for embracing out-of-the-box solutions and creative thinking has helped us become the partner of choice for our investors, many of whom have been working with OCCH for 30 years.

We are grateful to the Ohio Equity Fund XXVIII Investors, including the Impact Investors who commit a percentage of their equity investment to the Ohio Capital Impact Corporation (OCIC). OCIC administers all philanthropic activities that benefit our residents and neighborhoods.

2018 OHIO EQUITY FUND XXVIII INVESTORS

INVESTORSAMOUNT INVESTED

Private Investment$50,000,000

Huntington Community Development Corporation ☆$45,000,000

US Bank Community Development Corporation$35,000,000

Key Community Development Corporation ☆$30,000,000

Wells Fargo$27,000,000

BB&T$15,000,000

Fifth Third Community Development Corporation ☆$15,000,000

Park National Bank$8,000,000

First Financial Bank ☆$7,000,000

WesBanco Bank ☆$7,000,000

Peoples Bank$5,000,000

United Bank$5,000,000

First Federal Bank of the Midwest ☆$3,000,000

Heritage Bank ☆$3,000,000

Home Savings Bank$3,000,000

Republic Bank ☆$2,500,000

Belmont Savings Bank$2,000,000

Civista Bank ☆$2,000,000

First National Bank of PA$2,000,000

LCNB National Bank$2,000,000

Central Bank & Trust Company$1,000,000

City National Bank$1,000,000

Cortland Savings and Banking Co.$1,000,000

Farmers National Bank of Danville$1,000,000

Kentucky Bank*$1,000,000

CFBank ☆$500,000

First National Bank of Pandora$500,000

First State Bank* ☆$500,000

RiverHills Bank ☆$500,000

Total$275,500,000

*New OCCH Investor

☆ Impact Investors

2018 INVESTMENT NUMBERS

OCCH helped create and preserve 2,274 units of quality, affordable housing in 2018 by investing $283 million in 42 housing developments. More than just providing equity, we are your partner from project inception through the life of the project. Through the relationships we have forged with our investment and development partners, we are changing lives, revitalizing neighborhoods, creating jobs, and contributing to the health and wellbeing of society.

Projects Closed

Units Constructed or Rehabilitated

In Investments Made

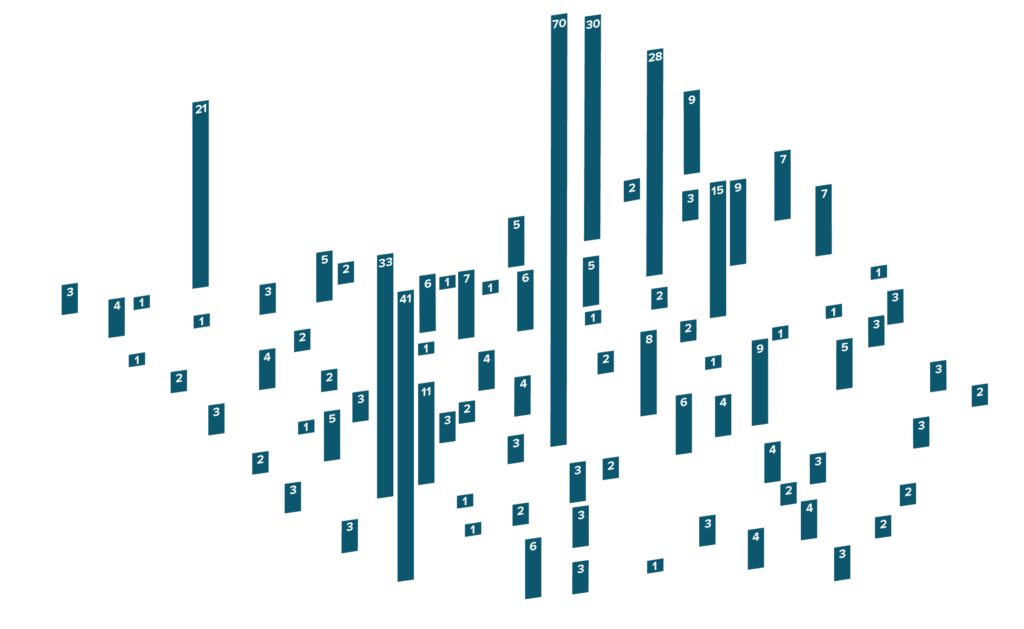

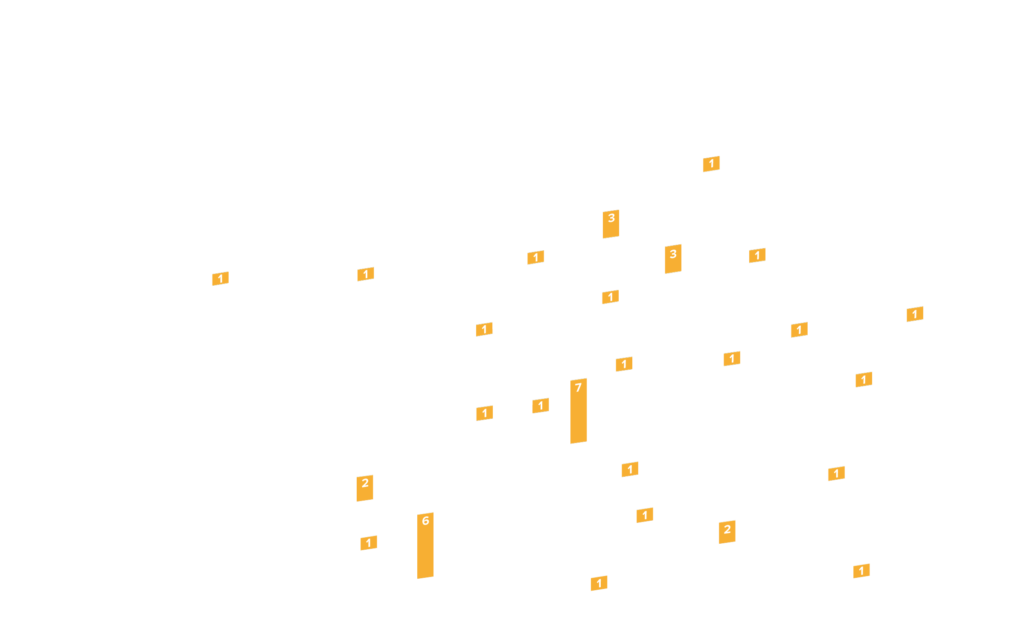

Ohio Portfolio

OCCH is committed to our core business and mission—creating opportunities for affordable, sustainable, safe housing for working families, seniors, and special needs populations in rural, urban, and suburban communities. We are committed to ensuring that the developments we invest in remain viable with continued financial and operational oversight. We work with our partners to navigate industry changes and help build capacity in the development and management of affordable housing.

Stabilized

Leasing / Construction

In Development

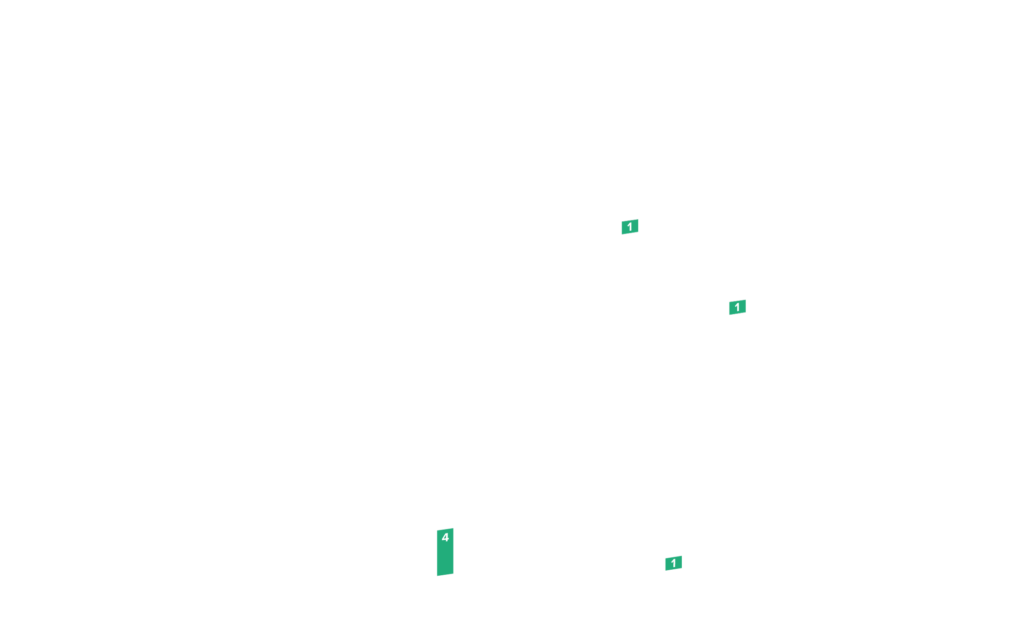

Kentucky Portfolio

Stabilized

Leasing / Construction

In Development

Featured Projects

Through our multi-investor funds and proprietary funds, OCCH provides equity to develop or preserve affordable housing for seniors, families, and special needs populations. Our portfolio includes passive housing, workforce housing, housing for student parents attending college, housing that transitions youth from foster care, and recovery housing with a rehabilitation component.

Sheakley Center for Youth – Homeless Youth Housing Program

New Construction, Permanent Supportive Housing | Cincinnati, Ohio

The Sheakley Center for Youth is the adaptive reuse of an existing warehouse into 39 units of permanent supportive housing in Cincinnati, Ohio. The Sheakley Center for Youth, developed by Model Property Development, Inc., and New Life Properties, Inc./Lighthouse Youth Services, employs a Housing First model to target homeless transition aged youth aged 18-24 who are living on the streets or in emergency shelter. The anticipated length of tenancy is 18 months, however no one will be evicted due to age. The goal is to transition the residents into more independent housing and life opportunities.

The Sheakley Center, managed by POAH Communities, is designed to create a single site where youth can enter from the streets for immediate stabilization through street outreach and resource center services, a safe and structured emergency shelter, and permanent housing. The building also houses Lighthouse Youth Services programming, services and administrative offices. Since 1969, Lighthouse Youth Services has developed a continuum of shelter, services and aftercare designed to provide skills to encourage responsibility and independence.

Sheakley Center for Youth was developed using Low Income Housing Tax Credits and an HDL Loan administered through the Ohio Housing Finance Agency. Funding sources include City of Cincinnati HOME funds, KeyBank financing, and Federal Home Loan Bank of Cincinnati funding. An equity investment of $6.3 million was provided by Ohio Capital Corporation for Housing.

Highland Village – A Return to Senior Housing

New Construction, Senior Housing | Highland Heights, Kentucky

The Highland Village project was created in response to a significant loss of subsidized housing for seniors in Campbell County, Kentucky and is also a model for integration of affordable housing into suburban communities. Developed by Newport Millennium Housing Corporation III, Highland Village is located in the affluent suburban community of Highland Heights, which had been without senior housing since 2013. The development consists of 104 units in a single three-story building and 14 garden style apartments in 7 duplexes.

Highland Village offers desirable amenities to its residents, such as a walking trail, fitness center, computer center, salon, community patio, community garden, and courtyard. The garden style apartments have attached garages, front porches, and private patios. Amenities inside the homes include central air conditioning, balconies, washer/dryer hookups, ceiling fans, and appliances. The Housing Authority of Newport manages the property.

Highland Village was developed using Low Income Housing Tax Credits administered through the Kentucky Housing Corporation. Funding sources include CDBG Funds, Stock Yards Bank financing, Kentucky Affordable Housing Trust Funds, Federal Home Loan Bank of Cincinnati AHP grant, State of Kentucky Department of Transportation Replacement Housing Mitigation Funds, and Ohio Capital Finance Corporation. An equity investment of $14.5 million was provided by Ohio Capital Corporation for Housing.

University Apartments – Rural Housing Rehabilitation

Rehabilitated Housing, Family Housing | Elizabethtown, Kentucky

Developed by Wabuck Development Company and Parkland Manor, University Apartments is the rehabilitation of 45 units of a USDA Rural Development affordable family housing development in Hardin County, Kentucky. University Apartments, originally placed in service in 1983, contains 5 two-story and 2 one-story residential buildings with a mix of one-, two-, and three-bedroom units.

As part of the rehabilitation of University Apartments, individual units and common space areas were significantly improved to include new vinyl plank flooring, energy efficient light fixtures, new appliances, new HVAC systems, new cabinets, energy efficient windows, new doors, and improvements to accessibility. Residents also enjoy a basketball court, playground, community benches, laundry facilities, and a mangers’ office located onsite.

University Apartments was developed using Low Income Housing Tax Credits administered through the Kentucky Housing Corporation. Funding sources include a construction loan provided by Cecilian Bank, Federal Home Loan Bank of Cincinnati AHP grant, funding provided by USDA Rural Development 515 Program, and Parkland Manor. An equity investment of $3 million was provided by Ohio Capital Corporation for Housing.

The Community Gardens – Pocket Neighborhood Development

New Construction, Senior Housing | Springfield, Ohio

The Community Gardens is a 50-unit affordable senior housing development in Clark County, Ohio that incorporates the innovative Pocket Neighborhood concept pioneered by Ross Chapin. A pocket neighborhood is a type of planned community that consists of a grouping of smaller residences around a shared open space designed to promote a close knit sense of community and neighborliness with an increased level of stewardship and connectivity.

Developed by Buckeye Community Hope Foundation and Neighborhood Housing Partnership of Springfield, The Community Gardens residential buildings are positioned in rows of duplex and triplex buildings with greenspace between the buildings. A community building located within walking distance of all residential buildings houses onsite management and resident services. Amenities include a playground, gazebo, community patio, health clinic, and walking paths.

The Community Gardens was developed using Low Income Housing Tax Credits and HDAP Funds administered through the Ohio Housing Finance Agency. Financing Partners include RiverHills Bank, City of Springfield, NeighborWorks America, and Federal Home Loan Bank of Cincinnati. An equity investment of $8 million was provided by Ohio Capital Corporation for Housing.

Laurel Green – Service Enriched Housing Community

New Construction, Permanent Supportive Housing | Columbus, Ohio

Community Housing Network developed Laurel Green in Franklin County, Ohio to provide service enriched housing to individuals with a mental health diagnosis that are struggling economically to maintain independent living but who may not qualify for housing restricted to homeless individuals. The 40 one-bedroom apartments feature energy efficient appliances, central air conditioning, an intercom system, and furniture.

Services to the residents are also available by community based mental health service providers from the Franklin County Alcohol, Drug, and Mental Health’s (ADAMH) service provider network both on-site at Laurel Green and offsite. Laurel Green offers on-site management, a community room with kitchen, computer center, laundry facilities, art therapy/fitness room, controlled entry and resident lounge areas.

Laurel Green was developed using Low Income Housing Tax Credits and HDAP Funds administered through the Ohio Housing Finance Agency. Financing Partners include Huntington National Bank, City of Columbus, Franklin County, Ohio Department of Mental Health and Addiction Services, Federal Home Loan Bank of Cincinnati, and ADAMH. An equity investment of $2.7 million was provided by Ohio Capital Corporation for Housing.

Fairwood Commons – Ohio’s First Passive House Development

New Construction, Senior Housing | Columbus, Ohio

Woda Cooper Companies, Inc. and East Columbus Development Company, Inc. developed Fairwood Commons, 54 units of affordable senior housing, in the historic Franklin Park neighborhood in Columbus, Ohio. Fairwood Commons is the first Passive House Project in Ohio, designed to be energy efficient, comfortable, affordable, and ecological at the same time. Passive House emphasizes super-insulation and air-tightness combined with high-performance windows and proper orientation and shading to significantly reduce heating and cooling consumption, reducing utility costs for both the building and the resident.

Amenities in the development include a community programming and outreach room, exercise room, on-site management, grandchild playroom, storage, recreational areas, and laundry room. A public Arts Garden funded by a grant through the Ohio Capital Impact Corporation’s (OCIC) Place-Based Strategies Program will feature sculptures from local artists.

Fairwood Commons was developed using Low Income Housing Tax Credits and loans administered through the Ohio Housing Finance Agency. Financing Partners include Huntington National Bank and the City of Columbus. An equity investment of $10 million was provided by Ohio Capital Corporation for Housing.

West Union Square – Revitalization of Colerain Avenue Corridor

New Construction, Senior Housing | Cincinnati, Ohio

West Union Square, developed by Cincinnati Metropolitan Housing Authority, with the active participation of Colerain Township, is one component in a larger planning effort to revitalize the Colerain Avenue Corridor in Hamilton County, Ohio. The 70-unit affordable senior housing development replaced blighted multi-family developments afflicted with substandard living conditions and widespread crime.

West Union Square offers on-site property management, a computer center, fitness room, community room, theater, and outdoor space. The building is designed to meet Enterprise Green Communities, and provides energy efficient appliances. Supportive services are also provided to the residents through local partnerships and focus on assisting residents in maintaining independent living skills and promoting an interactive and vibrant community.

West Union Square was developed using Low Income Housing Tax Credits and loans administered through the Ohio Housing Finance Agency. Financing Partners include Huntington National Bank, Federal Home Loan Bank of Cincinnati, Hamilton County, and Cincinnati Metropolitan Housing Authority. An equity investment of $9.9 million was provided by Ohio Capital Corporation for Housing.

Abington Race and Pleasant Apartments – Historic Rehabilitation in Over-the-Rhine

Historic Rehabilitation, Family Housing | Cincinnati, Ohio

Abington Race and Pleasant Apartments is the historic renovation of 50 units of scattered site family housing in the Over-the-Rhine neighborhood in Cincinnati, Ohio. Consisting of five buildings originally constructed in the late 1800s to early 1900s, the rehabilitation is part of a larger revitalization effort in the Over-the-Rhine neighborhood. Divided into two separate condominium buildings, the development includes both commercial spaces and residential units. The Over-the-Rhine neighborhood is a residential, walkable urban community close to numerous services and recreational activities in downtown Cincinnati.

Developed by Model Property Development, LLC and Cornerstone Corporation for Shared Equity, Abington Race and Pleasant Apartments include studios, one-two, and three-bedroom units and feature an open design. Renovations include new kitchen and bathroom fixtures and cabinetry, new heating and cooling systems, and new flooring.

Abington Race-Pleasant Apartments was developed using Low Income Housing Tax Credits and loans administered through the Ohio Housing Finance Agency. Financing Partners include City of Cincinnati, JPMorgan Chase Bank, Ohio Equity Fund (OEF) Fifth Third Fund V, Federal Historic Credits, and State Historic Credits. An equity investment of $9 million was provided by Ohio Capital Corporation for Housing.