Ohio Capital Finance Corporation

Expansion and new capital marked two of the accomplishments for OCFC in 2018. Led by the implementation of the OCFC’s 2017 Capital Magnet Fund Award from the CDFI Fund and the creation of the Southside Renaissance Fund, OCFC provided 52 loans to affordable housing developers with total production exceeding $44,000,000 and assisting with the production and preservation of over 2,700 units.

OCFC also developed a new targeted loan fund to serve Cincinnati and Hamilton County. In its first year of operation, the Cincinnati Neighborhood Transformation Fund lent $4,323,000 to assist in the preservation of affordable housing while assisting in spurring economic development through commercial development lending.

OCFC was generously awarded a Financial Assistance grant of $1,525,000 from the CDFI Fund which will allow OCFC to create a new Recovery Housing lending program. This unique partnership between recovery housing providers, the Ohio Department of Mental Health and Addiction Services, and the Ohio Council of Behavioral Health & Family Services Providers seeks to increase the number of Recovery Houses in Ohio to assist in the treatment of those dealing with addiction.

Additionally, OCFC was the recipient of the highly competitive 2018 Capital Magnet Fund program. OCFC will utilize its $4,900,000 award to provide additional sources of capital for projects located in Kentucky and West Virginia.

OCFC’S core product lines continue to expand to meet the needs of affordable housing developers and provides a full range of services including predevelopment financing, acquisition financing, equity bridge / construction loan financing, and permanent financing.

OCFC operates five revolving loan funds:

– Ohio Affordable Housing Loan Fund

– Ohio Preservation Loan Fund

– OCFC Capital Magnet Loan Pool

– Southside Renaissance Fund

– Cincinnati Neighborhood Transformation Fund

OCFC is a Community Development Financial Institution (CDFI) Entity, as certified by the United States Department of the Treasury.

Member of:

Making a Difference through Community Partnerships

“Nationwide Children’s is proud to partner with Ohio Capital Finance Corporation on the South Side Renaissance Fund. The innovative fund enables the expansion of the hospital's Healthy Neighborhoods Healthy Families affordable housing efforts in support of our mission to promote the health of children and families.”

—Angela Mingo, OCCH Board Member, Community Relations Director, Nationwide Children’s Hospital

OCFC expanded its reach in 2018 beyond tax credit lending to encompass neighborhood transformation and preserve naturally occurring affordable housing. OCFC established the South Side Renaissance Fund in partnership with Nationwide Children’s Hospital, Healthy Homes and Community Development for All People to continue their missions of making a significant, positive difference to the neighborhoods on the South Side of Columbus. OCFC developed and structured a $20 million loan fund to provide long-term funding for the acquisition, construction and permanent financing of up to 170 units of single and multifamily rental housing, serving families with incomes between 60 and 80 percent of area median income, or $45,840 to $61,100 for a family of four.

The fund is made possible with low-interest loans from financial institutions who also care about the future of the South Side. In addition to rental housing, it will also provide financing for impactful and transformative community development projects.

The funders include Fifth Third Community Development Corporation, First Financial Bank, First Merchants Bank, Huntington Community Development Corporation, JPMorgan Chase, PNC Bank, The Union Bank, The Affordable House Trust for Columbus and Franklin County and Ohio Capital Finance Corporation.

South Side Project

Before & After

South Side Project

Before & After

In partnership with the OH3C, a collaboration for four Community Development Financial Institutions (CDFI), OCFC was awarded a $1M grant from the JPMorgan Chase Foundation. This contribution will assist OCFC in furthering its lending efforts and creating additional affordable housing on the Southside of Columbus. In total, the OH3C initiative received a $3,000,000 grant which will be utilized in partnership with the Cincinnati Development Fund, Economic and Community Development Institute and Village Capital Corporation to impact neighborhoods within Cincinnati, Columbus, and Cleveland.

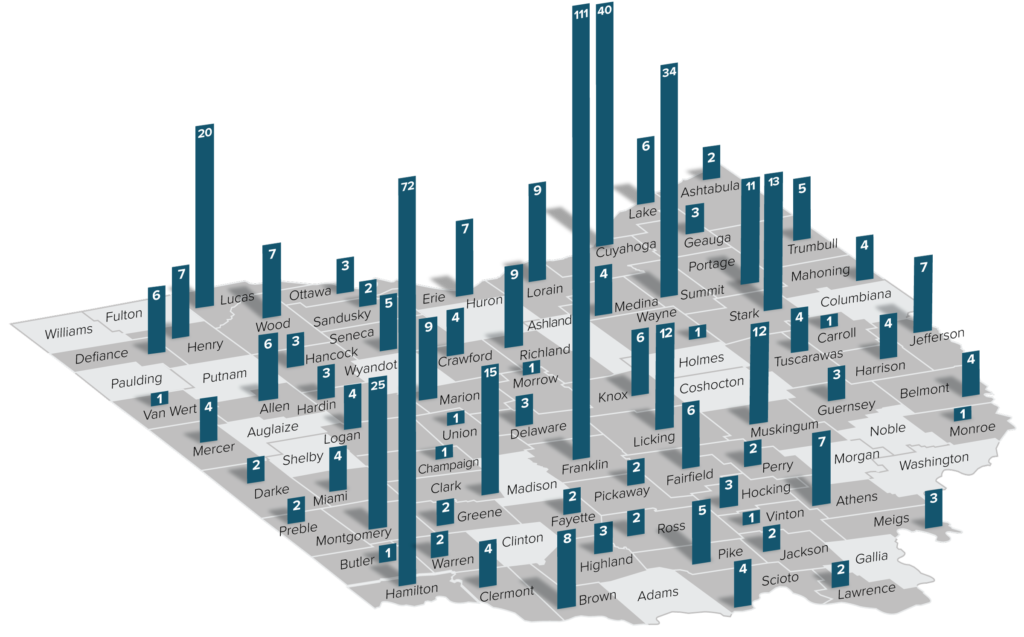

Ohio Loans by County

OCFC has provided loans in 78% of Ohio’s counties.

OCFC’s mission of “providing a flexible source of capital to increase and improve the supply of affordable rental housing across Ohio” has remained steadfast while expanding to meet market needs.

OCFC Investors

Since 2002, OCFC has generated over $495 million in 627 loans utilized to develop and finance 25,934 units of affordable housing (30% of which were preservation) across Ohio. OCFC is grateful to its investors and participants for their commitment to affordable housing while being mindful of the needs of its borrowers.

OCFC Investors & Participants

PNC Community Development Corporation$18,950,000

First Financial Bank$14,250,000

Fifth Third Bank$7,000,000

First Federal of Lakewood$7,000,000

Huntington Community Development Corporation$7,000,000

KeyCorp Community Development Corporation$7,000,000

First National Bank of PA$5,800,000

John D. and Catherine T. MacArthur Foundation$4,000,000

Ohio Housing Finance Agency$4,000,000

US Bank Community Development Corporation$3,500,000

WesBanco Bank$3,500,000

The Affordable Housing Trust$3,400,000

National Coop Bank$2,450,000

First Merchants Bank$2,250,000

RiverHills Bank$1,500,000

Heritage Bank$1,000,000

The Union Bank Co.$1,000,000

WoodForest Bank$1,000,000

First State Bank$500,000

CF Bank$250,000

Total$95,350,000

Accomplishments 2002-2018

Units financed (30% of which were preservation)

Loans closed

Total loan production

OCFC has provided loans in 78% of Ohio’s counties

2018 Loan Production Distribution

Number of Loans

Hover over the pie chart for more details about each loan.

Predevelopment

Acquisition

Y15

Equity Bridge/Construction

Permanent

Amount of Loans

Hover over the pie chart for more details about each loan.

Predevelopment

Acquisition

Y15

Equity Bridge/Construction

Permanent